Types of Elterngeld in Germany

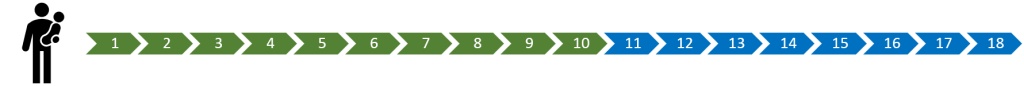

Parental Allowance (aka Elterngeld) is a financial benefit for parents with babies or toddlers in Germany. It aims to enable parents to take time to be with their child, by helping families to continue securing their financial income and there are 3 types of Elterngeld in Germany.

This information about Elterngeld (or parental allowance in Germany) applies for parents whose children were born after August 2021. And if your child was born before 1 September 2021, in some cases different rules apply.

Elterngeld and Elternzeit are two different things in Germany. You can get one with or without the other, and the application for both are very different. However you should have a plan on how you want to do this whole Eltern Zeit und Geld to be sure you aply correctly and on time to what you want and need.

Check here an overview of what Elterngeld is and tips on how to apply.

In Germany parents have to chose between 3 types of Elterngeld

- Basic Parental Allowance, in German Basiselterngeld,

- Parental Allowance Plus, or Elterngeldplus, and

- Partnership Bonus, the Partnerschaftsbonus

There is a lot to understand before making choices and, on top of that, it is possible to combine these types of Elterngeld in different ways to find the best option for you and your family.

Basic Parental Allowance or Basiselterngeld

This type of Elterngeld in Germany can be paid for 12 months of your child’s life, but if both parents apply for Parental Allowance and one of you is earning less than before the child’s birth, you can actually claim for up to 14 months. These two additional months are called “Partner Months”, and they are available also for single parents. Both parents can apply for Parental Allowance at the same time or alternately and you can divide the total of 14 months between you two as you wish. However, each one must apply for a minimum of two months and no more than 12 months.

You can either receive the Basic Parental Allowance continuously or interrupt your Parental Allowance and continue to receive it later.

Let’s check an example:

The mother receives Basic Parental Allowance the first 7th months, the father in months 8 through 14. This means that the parents have used up the full 14 months of Basic Parental Allowance.

There are three restrictions to claiming Basic Parental Allowance:

- You can only receive Basic Parental Allowance in the first 14 months of your child’s life. After this you can only claim Parental Allowance Plus or the Partnership Bonus.

- The daily maternity allowance paid by a private health insurance count as months of Basic Parental Allowance.

- If you are the child’s mother, the months of your child’s life during which you receive Maternity Pay or other maternity benefits are also the months in which you can receive Basic Parental Allowance. This means you are automatically using up these months (usually the first 2 months after birth) for Basic Parental Allowance. During these months, you cannot receive either Parental Allowance Plus or Partnership Bonus. However, the other parent (that is not the mother receiving Maternity Pay or maternity benefits) can decide which type of Parental Allowance he or she wish to receive during this period.

Let me explain this with an example:

The mother receives Maternity Pay for the first two months of the child’s life. She receives Basic Parental Allowance from month 3 to month 10 of the child’s life, while the father receives Basic Parental Allowance from month 11 up to and including month 14 of the child’s life. This means that both parents have used up their 14 months of Basic Parental Allowance together: the mother 10 months, the father 4 months.

Parental Allowance Plus or Elterngeldplus

Elterngeldplus or Parental Allowance Plus is available for twice as long as Basic Parental Allowance.

If you do not work after the child’s birth, Parental Allowance Plus is half the amount of Basic Parental Allowance. If you work part-time after your child’s birth the Parental Allowance Plus paid each month can vary and might even be the same amount per month as the monthly Basic Parental Allowance and you can still receive Parental Allowance Plus for twice as long and up to 32 months.

In this case, the calculation of how much allowance you receive takes into account the difference between your income before and after the child’s birth.

There are two restrictions to claiming Parental Allowance Plus:

- If you receive Maternity Pay or other maternity benefits as the mother of the child, you cannot claim Parental Allowance Plus during this time, only Basic Parental Allowance.

- When your child reaches the age of 14 months, you can only claim Parental Allowance Plus without interruption. If the other parent also claims Parental Allowance, you can alternate after the child reaches the age of 14 months.

- However, if neither of you is claiming Parental Allowance in any month after your child reaches the age of 14 months, you cannot claim Parental Allowance afterwards – even if you still have months left over.

Here two examples on how it is possible to combine Basic Parental Allowance with Parental Allowance Plus:

The mother receives automatically Maternity Pay for the first two months of the child’s life. These count as months of Basic Parental Allowance. The father gets Basic Parental Allowance for month 3 and then Parental Allowance Plus from month 4 to 25. These are 3 months of Basic Parental Allowance and 22 months of Parental Allowance Plus, equivalent to 14 months of Basic Parental Allowance.

Now an example on how a single parents might combine Basic Parental Allowance and Parental Allowance Plus:

A single father receives Basic Parental Allowance during the first ten months of his child’s life. From month 11 to 18 Parental Allowance Plus. 10 months of Basic Parental Allowance and 8 months of Parental Allowance Plus; this is equivalent to 14 months of Basic Parental Allowance.

Partnership Bonus or Partnerschaftsbonus

The Partnership Bonus or Partnershaftsbonus (in German) gives you additional 2 to 4 months of Parental Allowance Plus and you may also get it even if you and the other parent are raising your child separately. If you are a single parent, it is available to you on your own.

Requirements to get Partnership Bonus:

- Both parents claim the Partnership Bonus at the same time.

- You apply for the Partnership Bonus for a minimum of two and a maximum of four consecutive months.

- You both work part-time during this period, each at least 24 hours per week and maximum 32 hours per week. The same rule for single parents.

- As it happens in Parental Allowance Plus, when your child reaches the age of 14 months, you can only claim Partnership bonus without interruption. If the other parent also claims Parental Allowance, you can alternate after the child reaches the age of 14 months. However, if neither of you is claiming Parental Allowance in any month after your child reaches the age of 14 months, you cannot claim Parental Allowance afterwards – even if you still have months left over.

You are also eligible for the Partnership Bonus if you are studying or in training. It is sufficient if you spend at least 24 hours a week on your training for example. You may pursue studying or training for more than 32 hours a week.

It is not necessary for you to work exactly 24 to 32 hours in every single week. The key factor is how many hours per week on average you work per month. If you work less than 24 hours or more than 32 hours in a month of the child’s life, you must repay the Partnership Bonus for that month. Even if only one of the two parents does not meet the requirements, both lose the Partnership Bonus for that month. This does not affect the other months if you meet the requirements for the Partnership Bonus in at least two months of the child’s life. You are allowed to retain the Parental Allowance for these months. It will not be reclaimed.

Let me give you an example here:

Both parents receive Parental Allowance Plus for the first 14 months of the child’s life. Afterwards, both parents wish to claim the Partnership Bonus. The mother works 26 hours per week and the father 32 hours from month 15 to 18. But he does additional overtime in month 17. This increases his average working hours to 34 hours per week. As a result, neither parent is eligible for the Partnership Bonus for this month. The mother and father must, therefore, both pay back the Partnership Bonus for month 17, but they keep the Partnership Bonus for the other months.

Combining different types of Elterngeld in Germany?

But all these Elterngeld in Germany modalities might also be combined. Which might be complicated to plan, but it allows you to get the best option for you and your family. If you are planning on combining several modalities of parental allowance in Germany don’t forget to check all the rules and restrictions for that.

Just so you get an idea I will give you an example on how it might be done:

The mother receives Basic Parental Allowance for the first six months of the child’s life. In months 7 and 8, parents receive the Partnership Bonus. From month 9 to 12, the father receives Basic Parental Allowance. The mother receives Parental Allowance Plus from month 11 to 18.

Only you know what is the best type of Elterngeld for you!

Your circumstances and your plans will determine whether is better for you the Basic Parental Allowance, Parental Allowance Plus, the Partnership Bonus or a combination of two or all three.

The main questions you should ask yourselves are:

- Do we work or want to work?

- Do we want to be full time with our children? For how long?

- When do we want to go back to work?

- But also, and very important: How much money do we need each month?

You can find more information about Parental Allowance on the internet: A lot of information on Parental Allowance is available online at the familienportal website.

If you would like to call or send an email to get more and detailed information about the different types of Elterngeld in Germany:

You can call 115, the service line offered by the Federal Ministry of Family Affairs, to get advice on the phone for topics as:

- The requirements for claiming Parental Allowance

- Where to get the application form

- Which Parental Allowance Office is responsible for you.

There is a service line offered by the Federal Ministry of Family Affairs (030 201 791 30 info@bmfsfjservice.bund.de).

You can also get information on your Parental Allowance Office (depending on where your child’s place of residence is).

Of course there is much more information about the Parental Allowance in Germany, don’t forget to check my other posts and videos to know more detailed information about the different types of Elterngeld in Germany.

If you want to check more about parental allowance please consult the “Parental Allowance and Parental Leave” booklet.

Before checking the different types of Elterngeld or even Elternzeit, you need to take care of Mutterschutz and Mutterschutzgeld, check here how it works.

But of course, if you have further questions that I might be able to help you or point in the right direction let me know on the comment section!

You may also like

Midwife in Germany: vocabulary you need after the baby arrives

December 12, 2019

Being late in Germany with kids

December 10, 2021